Global stock markets kicked off the fourth quarter of 2025 on shaky ground as the U.S. government officially entered a shutdown, raising fears of political gridlock and economic slowdown. Investor confidence wavered, sending gold prices to a new record high and sparking volatility across key sectors.

Government Shutdown 2025: Uncertainty Clouds Market Outlook

After failing to pass a federal funding bill late Tuesday, Washington lawmakers triggered the first U.S. government shutdown since 2023. The closure halts nonessential government operations and delays crucial economic reports—including employment, inflation, and GDP data—that the Federal Reserve relies on for its next policy move.

“Markets hate uncertainty, and this shutdown adds another layer of complexity ahead of the Fed’s next move,” said Lydia Benson, Chief Economist at Meridian Capital. “Without key data, the Fed’s inflation and growth outlook becomes harder to gauge.”

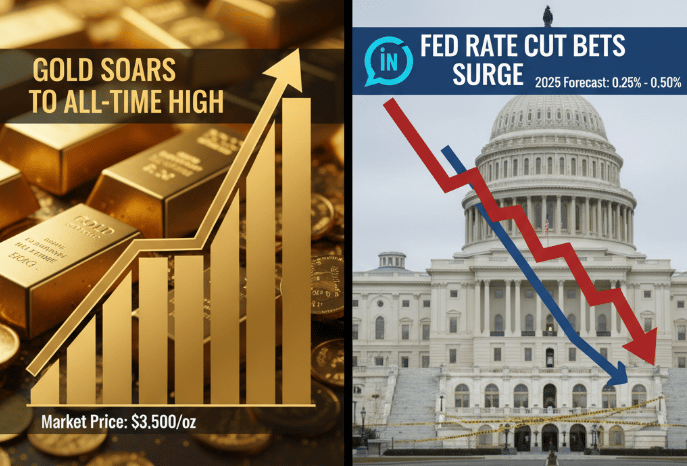

With the data blackout looming, investors are now pricing in a 96% probability of a Fed rate cut at the October meeting—up from 90% earlier this week. The Federal Reserve interest rate outlook has become a major focus for traders looking to navigate the turbulence.

Gold Hits Record High as Investors Flee to Safe Havens

As political tensions rose, investors rushed into safe-haven assets. Gold prices surged to an all-time high of $3,875 per ounce, reflecting deepening anxiety about fiscal uncertainty. Meanwhile, U.S. Treasury yields dipped as bond demand increased, and the U.S. dollar weakened, signaling growing caution among global investors.

Sector Watch: Pharma Leads, AI Infrastructure Soars, Fintech Falters

Despite the S&P 500 closing nearly flat at 666.18 (+0.39%), sector performance told a more nuanced story, highlighting both opportunities and risks for investors.

Pharma Stocks Surge on New Developments

Pfizer (PFE) jumped 7% after the launch of “TrumpRx”, a new digital pharmaceutical marketplace featuring several blockbuster drugs.

Merck (MRK) climbed 5%, buoyed by new regulatory approvals in Europe and a strategic partnership in Canada.

Pharma remains one of the top defensive sectors in times of volatility, appealing to investors seeking stability amid macro uncertainty.

AI Infrastructure Boom Continues

CoreWeave (CRWV) soared 12% after announcing a $14 billion AI chip supply deal with Meta Platforms.

The move reinforces the AI infrastructure investment trend, even as enthusiasm cools for consumer-facing AI startups.

Investors are increasingly favoring AI hardware and cloud infrastructure providers—companies building the backbone of the AI economy.

Fintech Stocks Stumble

Block (SQ) and Paycom (PAYC) both declined sharply, pressured by competition fears following OpenAI’s new partnership with Stripe.

The fintech sector faces headwinds from rising rates, tighter credit conditions, and growing competition in digital payments.

Market Rally Losing Steam?

After a strong first half of 2025 fueled by AI optimism and economic resilience, analysts warn that the record-breaking rally may be losing momentum.

“The market has come a long way since January, but cracks are forming,” said David Lin, Portfolio Strategist at Alpine Investments. “We’re seeing a rotation into defensives like healthcare, utilities, and gold.”

Rising bond yields, political uncertainty, and a maturing AI cycle are prompting many investors to rebalance portfolios toward low-volatility stocks and safe-haven assets.

Global Markets Mixed as Shutdown Ripples Abroad

Japan’s Nikkei 225: -0.4%

Hong Kong’s Hang Seng: +0.8%

UK’s FTSE 100: Flat

Overseas investors are watching closely as the U.S. shutdown raises concerns about global supply chains, trade policy delays, and U.S. economic growth.

Key Takeaways: What Investors Should Watch

Winners:

Gold — record highs signal strong demand for safety

Pharma — Pfizer, Merck leading defensives

AI Infrastructure — CoreWeave deal boosts sentiment

Losers:

Fintech — Block, Paycom face new competition

Consumer Discretionary — vulnerable to slowdown fears

Key Risks:

Prolonged shutdown could delay economic data, muddy Fed decisions, and weaken Q4 growth

Market volatility likely to remain elevated through October

Investor Strategy for Q4 2025

With Washington gridlock intensifying and economic signals mixed, investors may consider:

Increasing exposure to defensive sectors (healthcare, utilities)

Holding gold and Treasuries for stability

Watching the Fed’s October meeting for rate guidance

Staying agile with AI infrastructure and pharma leaders

The next few weeks could define the market’s direction for the rest of 2025—making risk management and diversification more critical than ever.